How Finance Works

Exploring Finance options online can be daunting but we’re here to help you find the right arrangement for you, be it HP, PCP or an alternative.

Financing your car online

Financing a car online couldn’t be easier and gives you better visibility of what a finance agreement might look like for you.

- First, find your ideal car. Check out our used cars to start your search today.

- Then, use the finance calculator on the right-hand side of the vehicle detail page to discover the right deal for you. Don’t forget to add part exchanges, extras, and choose your delivery method here too!

- Once you have found a deal you like, proceed to apply for finance online.

- Make sure you take the time to understand the terms of your agreement as the online application process may include a hard credit check. If you have any questions about your finance agreement, support, or understanding, contact us.

- We'll be in touch to confirm the next steps after you have submitted your application online.

What is Personal Contract Purchase (PCP)?

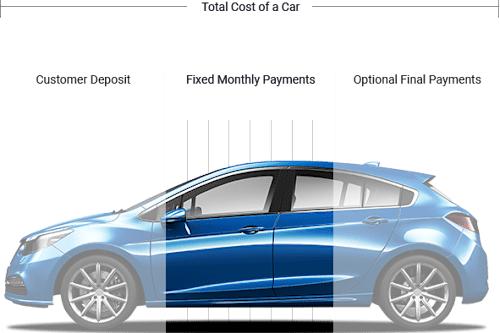

A Personal Contract Purchase is usually broken up into 3 sections. The first is a deposit. This is then followed by a series of fixed monthly instalments before you have the option to make a final payment (sometimes called a balloon payment) at the end in order to keep the vehicle. Consumers have the choice of returning the car, paying the final payment (which is dependent on resale value) or putting that resale value towards a new vehicle.

This option is generally better for people who like to change their car regularly.

Will I be approved for Finance?

You can find out right now by entering a few basic personal details, such as your name and address.

Your eligibility for finance is based on your credit profile, and it takes the form of a soft credit check which won’t affect your credit rating.

Can I get car finance even if I have bad credit?

It’s possible. We’ll review your particular circumstances, taking into consideration your employment status, income, the size of the loan, your age and your credit history. If successful, we’ll let you know the precise interest rates and payments that will be available to you.

What is APR?

APR stands for Annual Percentage Rate, and it includes charges and arrangement fees that are added to a car’s selling price.

What is the difference between a soft credit search and a hard credit search?

A soft credit search (which is used with our eligibility checker) is a basic background check that won’t affect your credit rating.

A hard credit search is completed only if you apply for financing. A record of the search will be added to your credit profile and may affect your overall score, albeit on a likely temporary basis.

We’ll only complete a hard credit search when absolutely necessary – and only after seeking your express permission.

What is Hire Purchase (HP)?

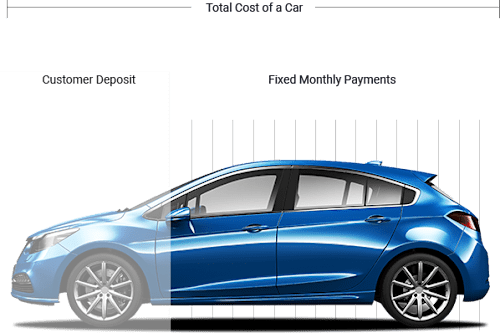

Hire Purchase is a plan where you usually pay a deposit, and then pay off the total vehicle value in monthly instalments. Once you have made your last payment, the vehicleis yours.

This option is generally better for somebody who wants to own the vehicle at the end of the agreement and can afford to pay more per month. If you don't have a high credit score, a hire purchase agreement may be easier to obtain as the car is used as collateral for the loan.

Will I be approved for Finance?

It’ll take just a few minutes to find out with our eligibility checker, which is a soft credit check that won’t affect your credit score. To begin, we’ll just need a few basic personal details, including your name and address.

Can I get car finance even if I have bad credit?

You may be eligible for car financing with us if your credit history is not the best. We’ll look at your personal circumstances, including your age, employment status, annual income, loan size and credit history.

If successful, we’ll provide you with details of the exact details of interest rates and monthly repayments that are available to you.

What is APR?

It stands for Annual Percentage Rate and it’s a figure that summarises how much you’ll need to pay each year for financing (i.e. the amount that’s added to your selected car’s purchase figure).

What is the difference between a soft credit search and a hard credit search?

Our eligibility checker is a form of soft credit search. It’s a simple background check that won’t affect your credit score.

If you apply for a loan with us, we’ll carry out a hard credit search. This will be recorded on your credit profile and will probably affect your score. However, it’s quite likely that this will only be for a limited amount of time.

We’ll only ever complete a hard credit search when necessary, and only after seeking your permission first.

We have trained finance specialists within all of our dealerships who pride themselves in offering outstanding customer service and assisting customers in finding the right funding solution to suit their pocket and individual circumstances.

With clear agreements and competitive finance packages available to suit your needs, we're confident we can help you get something special on your driveway.

Finding the right purchasing agreement is as important as selecting the right vehicle.

With this in mind, we have designed a number of attractive finance packages to make things that much easier.